Closing Costs: Understanding Closing Costs When Buying a Home.

Buying a new house is an exciting and important milestone in one’s life. But it’s important to realize that there are other expenses associated with property purchases that go beyond the purchase price itself. Closing fees are a crucial component of the home-buying process and can have a big impact on your overall costs. We will go into the idea of closing expenses in this post, look at the several parts that make them up, and give you a thorough knowledge of their relevance.

1. What Are Closing Costs?

Closing costs are the fees and expenses incurred when a real estate transaction is completed. These expenses, which are paid by both the buyer and the seller, often consist of a number of charges for the mortgage loan, the transfer of the property, and other administrative costs.

2. Why Closing Costs are Importance?

Understanding closing costs is essential because they have a big impact on the overall sum of money you need to budget for when buying a property. It’s critical to be aware of these expenses and make appropriate plans because they can add up to a significant number. Neglecting or underestimating closing fees might put a strain on your finances or thwart your intentions to buy a house.

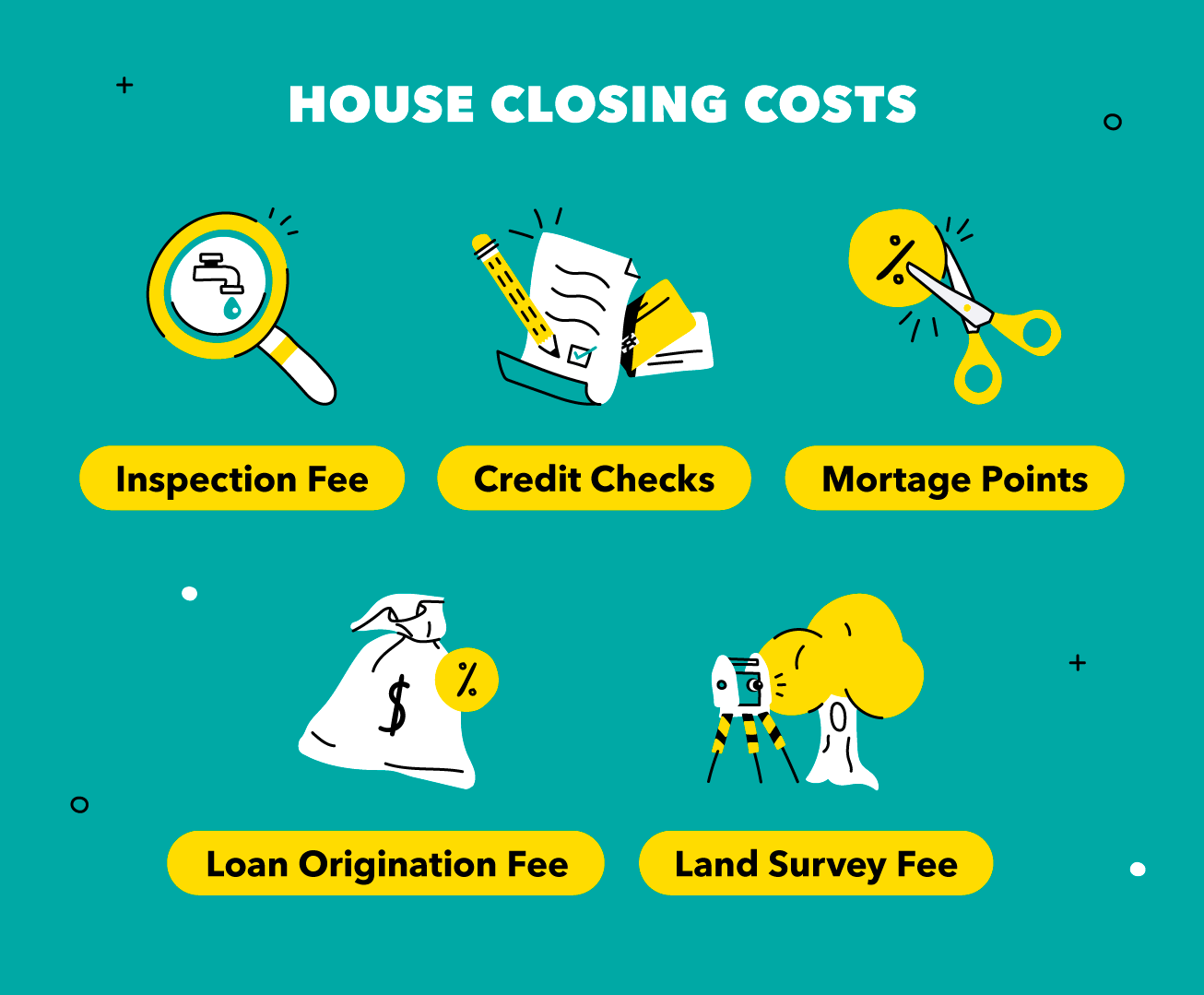

3. Understanding the Elements of Closing Costs.

– Fees for Mortgage Applications and Originations.

Lenders often impose application and origination fees when a mortgage application is submitted. These fees pay for the overhead associated with handling the loan application and creating the mortgage.

– Fees for appraisals.

The fair market value of the property must be ascertained by an appraisal. The appraisal fee covers the cost of engaging a qualified appraiser to appropriately determine the property’s value.

– Costs Associated with Home Inspections.

To find any hidden flaws or prospective difficulties with the property, a home inspection is necessary. The expense of engaging a certified inspector to evaluate the state of the property is covered by the home inspection costs.

–Title Search and Insurance.

A title search is performed to confirm that the title to the property is clean and unencumbered by any liens or legal difficulties before the purchase is finalized. The buyer and lender are shielded against potential title claims by title insurance.

– Legal Fees.

To handle the legal parts of the property buying process, it may occasionally be necessary to hire an attorney. Legal advice and document review are both included in attorney fees.

– Escrow and Prepaid Costs.

Escrow describes a neutral third-party account where money is kept while buying a house. Property taxes, homeowner’s insurance, and other charges that must be paid in advance are prepaid expenses.

– Real Estate Taxes and Insurance.

Prorated payments for property taxes and insurance premiums are frequently made at closing. These prices change based on the location of the property and the insurance plan chosen.

– Recording Charges.

The local government levies recording costs in order to formally record the ownership transfer documents.

– HOA Dues.

There could be HOA fees related to the sale of the property if it is a part of a HOA.

– Other Fees.

Closing costs may also include extraneous charges like courier costs, credit report prices, or document preparation costs.

4. How Much are Closing Costs?

Closing fees typically represent 2% to 5% of the overall cost of the house. However, the precise sum may change based on a number of variables, including the property’s location, the lender’s fees, and the intricacy of the deal.

5. Negotiating for Closing Costs with Seller.

In some circumstances, it could be able to bargain with the seller or the lender to reduce some closing fees. It’s critical to go over this possibility with your real estate agent or mortgage lender and look into feasible methods for lessening the financial strain.

6. Techniques for Lowering Closing Costs.

You can use a variety of tactics to reduce closing costs. These include comparing prices from several service providers, looking around for the best mortgage rates and conditions, and carefully reading the loan estimate and closing disclosure documents to look for any mistakes or inconsistencies.

7. Common Errors to Avoid.

Avoiding typical blunders that could lead to increased charges is essential when dealing with closing fees. Among these errors are failing to thoroughly investigate service providers, skipping through documentation, and omitting to bargain for or enquire about possible reductions or waivers.

8. A Real Estate Agent’s Function in Closing Costs.

A skilled real estate agent can help you negotiate the negotiation process and can walk you through the complicated world of closing fees. They can help to ensure a simple and affordable house-buying process by offering helpful insights, suggesting trustworthy service providers, and providing recommendations.

9. Closing Costs Versus Down Payment.

It’s crucial to understand that closing expenses are separate from the down payment. Closing costs are extra charges related to the transaction, whereas the down payment is a portion of the home’s purchase price paid beforehand. When making a house purchase budget, remember to account for both the down payment and closing costs.

Lastly, closing fees are a crucial step in the home purchase process that shouldn’t be ignored. You may make wise financial decisions and ensure a simpler and more reasonable home-buying experience by comprehending the various closing cost components and taking the necessary steps to control them.

FAQs

1. Can I finance closing costs?

Yes, it is sometimes feasible to finance your closing fees by including them in your mortgage. However, it’s crucial to take into account the long-term financial ramifications and speak with your lender to comprehend the precise terms and conditions.

2. Are closing fees tax deductible?

While some closing costs, like mortgage interest and property taxes, may be tax deductible, it is advisable to speak with a tax expert to understand the exact deductions available in your circumstances.

3. Can the seller cover the buyer’s closing costs?

It is feasible for the seller to cover the buyer’s closing costs. This can be discussed during the home-buying process and specified in the purchase agreement.

4. Are closing expenses the same for each house purchase?

No, closing expenses might vary depending on the property’s location, purchase price, mortgage lender, and other considerations. It’s crucial to get a loan estimate from your lender, which will list the anticipated closing expenses unique to your circumstance.

5. Is it possible for me to completely avoid paying closing costs?

There are ways to reduce closing costs, even though it may be difficult to totally avoid them. You can lessen the cost by comparing prices, haggling with service providers, and looking into possible reductions.