Zero-Based Budgeting: A Strategic Approach to Financial Management.

Zero-based budgeting (ZBB) is a systematic way of budgeting that goes against accepted conventions. With ZBB, every spending must be justified from scratch, starting from zero, in contrast to traditional budgeting, which bases future budgets on past ones. By doing this, businesses and people alike may fully comprehend their spending habits, get rid of waste, and allocate resources as efficiently as possible. In this post, we’ll analyze the idea of zero-based budgeting, go over its advantages, go over how to put it into practice, and look at how it can be used in both personal financial and corporate situations.

Understanding the Concept of Zero-based Budgeting

Zero-based budgeting is founded on the notion that every expenditure should be supported by its necessity and worth, rather than on past spending trends. ZBB demands a new analysis of each spending line item rather than automatically transferring previous budgets and making adjustments. Utilizing this strategy guarantees that resources are distributed wisely and in accordance with current priorities.

Now imagine that a business wishes to use zero-based budgeting (ZBB) for its marketing division. In ZBB, the budget for each period starts at zero and must be justified in light of the needs and goals of the department.

Here is an illustration of how this might function in numbers:

Prior spending:

- Public relations costs $20,000,

- Social media marketing $30,000, and

- Advertising $50,000

- Total marketing spends of $100,000.

Budgeting from zero Example:

- Marketing expenses: Based on recent campaigns and industry trends; the marketing department explains the necessity for $60,000 in advertising.

- Social Media Marketing: The department assesses the effectiveness of past efforts and decides that $40,000 is adequate for the coming time frame.

- Public relations: The department determines that $25,000 is needed for successful public relations after reviewing the company’s PR objectives and upcoming activities.

If zero-based budgeting were used, the marketing division’s new spending plan would be as follows:

- $60,000 was spent on advertising.

- Social media advertising costs $40,000.

- $25k in public relations

- Total marketing Budget spends of $125,000.

As you can see, zero-based budgeting requires departments to reevaluate their costs and justify them based on their current needs and objectives, as opposed to merely rolling over old budgets.

Benefits of Zero-based Budgeting.

There are various benefits to using zero-based budgeting. It gives businesses and people a comprehensive grasp of their financial situation, to start. ZBB increases efficiency by identifying wasteful spending and examining every expense. Since every spending must be justified and in line with the overarching strategic objectives, zero-based budgeting also promotes a culture of accountability and responsibility.

Implementing Zero-based Budgeting: Steps to Take

- Calculating and Identifying Expenses.

Identification and evaluation of all expenses is the first stage in putting zero-based budgeting into practice. Current spending habits, including fixed costs, variable expenses, and discretionary purchases, are carefully examined during this process. Organizations and people can assess each expense to decide whether it is necessary and what effect it will have on their overall financial situation.

- Categorized Costs.

The nature and purpose of each expense should be determined before grouping them into separate categories. Operational costs, marketing costs, research and development costs, and costs associated to employees are examples of common categories. Priorities can be set and the distribution of resources can be better understood with the aid of categorization.

- Prioritization and Financial Allocation.

Setting priorities and allocating cash appropriately comes after categorization. This entails figuring out which expenditures are essential and compatible with the overall aims and objectives. Resources ought to be distributed among the areas that support strategic efforts and add the most value.

- Maintaining and adjusting the Budget.

The practice of zero-based budgeting calls for regular monitoring and correction. By regularly examining the budget, businesses and individuals can spot outliers, make the necessary adjustments, and make sure that resources are being used to their full potential. Monitoring also makes timely corrections possible and promotes financial discipline.

Challenges and Restrictions of Zero-based Budgeting

While there are many advantages to zero-based budgeting, there are some drawbacks as well. It takes a lot of time and work to implement ZBB, especially in the beginning. The evaluation of each expense item might be labor- and resource-intensive. Furthermore, in some circumstances, it could be challenging to effectively predict future costs due to a lack of past data. Additionally, the ongoing evaluation and correction necessary for zero-based budgeting necessitate continual commitment and self-control.

Personal Finance: Zero-based Budgeting.

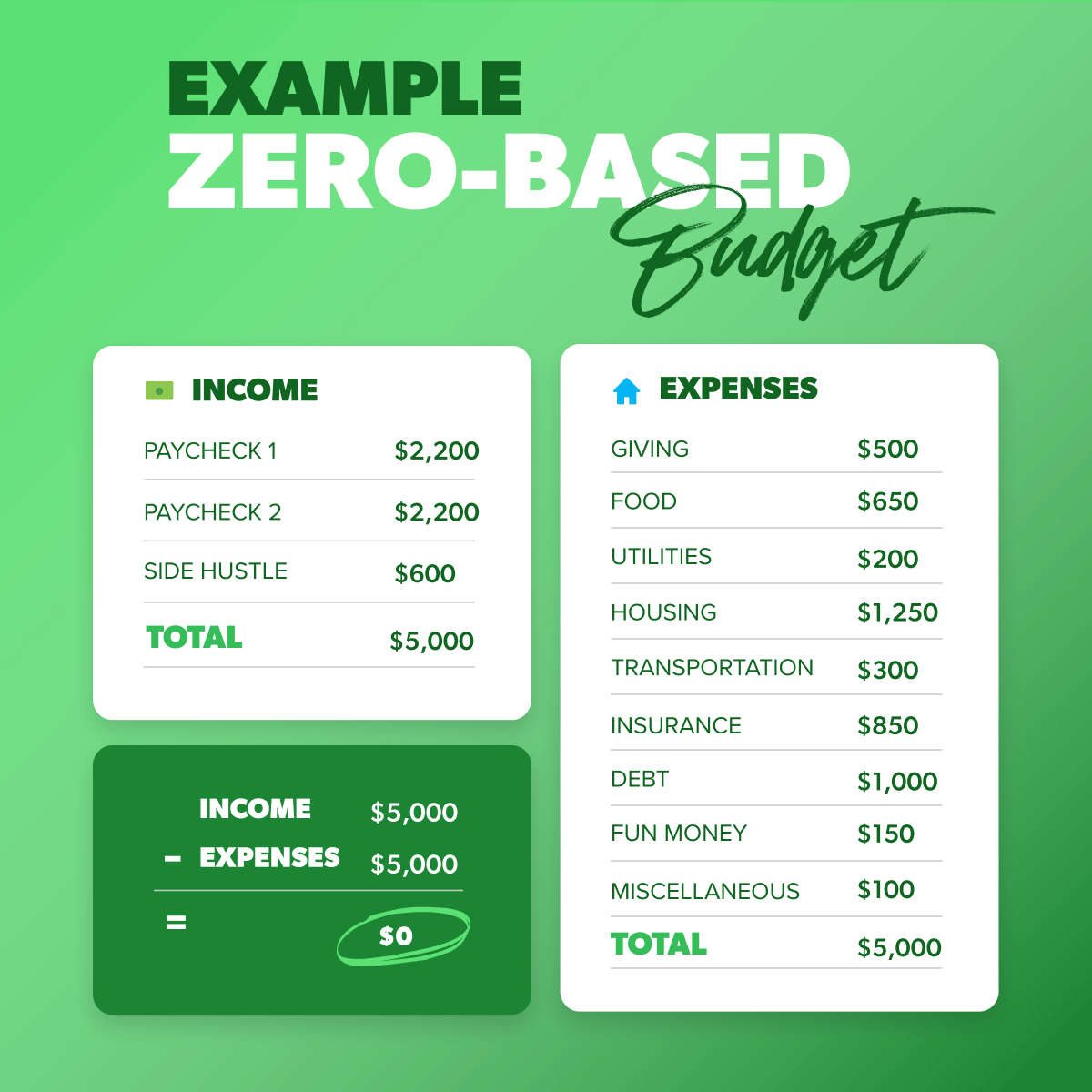

Individuals can also use zero-based budgeting to manage their own finances; it is not just for businesses. By using ZBB, people may take charge of their spending patterns, give priority to their financial objectives, and cut out pointless expenses. A thorough study of income and expenses is possible with this method, enabling people to make wise financial decisions and attain long-term financial stability.

Zero-based Budgeting for Business.

Zero-based budgeting is an effective strategy for managing finances in a company setting. Organizations can find places where costs might be cut or eliminated by closely evaluating each expense item. This strategy encourages resource optimization and strategic resource allocation, allowing organizations to allocate money in accordance with their priorities and objectives. Zero-based budgeting promotes a mindset of fiscal responsibility, accountability, and continual development.

Comparison of Traditional and Zero-based Budgeting.

Zero-based budgeting is very different from Traditional budgeting. Traditional budgeting is based on previous data and incremental changes, but zero-based budgeting starts from nothing and demands justification for every cost. Traditional budgeting could be less time-consuming, but it might also encourage inefficiencies and ignore opportunities for improvement. On the other hand, zero-based budgeting encourages a proactive approach to financial management while maximizing resource allocation and driving efficiency.

Zero-based budgeting is a tactical method of financial management that questions established budgeting procedures. Organizations and people can acquire a thorough grasp of their financial situation, get rid of waste, and allocate resources more efficiently by beginning from zero and analyzing every expense item. Zero-based budgeting encourages fiscal restraint, responsibility, and ongoing development whether it is used in personal or professional contexts.