There are many adverse effects on yourself and your lifestyle if you carry too much debt. As it will damage your credit by lowering your credit score, and once your credit score drops, you may only qualify for high-interest-rate loans, limiting your ability to cash flow. Not only that, having bad credit can impact your ability to land a job, as many employers tend to hire people with good credit because it is a sign of good character. Bad credit can also affect your ability to rent a place to live or buy a home, which is a significant drawback. Debt can adversely affect you and your health if you carry too much of it.

Here are some of the impacts that having too much debt can have on your lifestyle.

Financial Worries

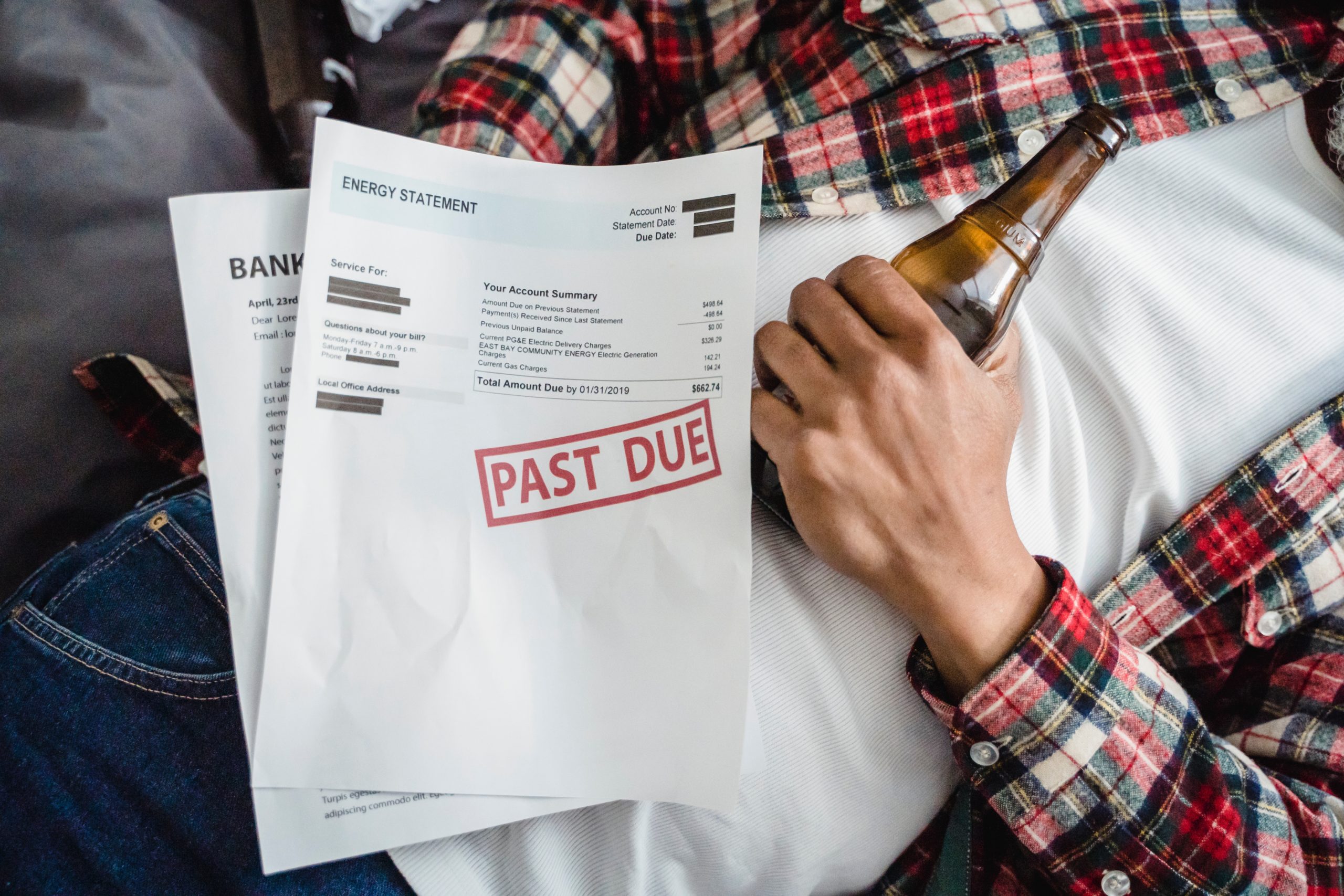

There is nothing worse than working hard every day but always finding yourself falling short of meeting your financial obligations. Having too much debt will undoubtedly make you spend a fair amount of your income on debt, making it a real struggle to cover your monthly expenses, creating never-ending money worries. These financial worries can affect your sleep, make you lose focus, and lead to substance abuse. Studies show that many people resort to drug and alcohol use to forget about their financial stress, leading to worse outcomes.

Lead to Stress

If you’re buried in debt, there is a good chance that you will experience a high level of financial stress. Studies show that people with large debts face constant pressure and anxiety, leading to additional health problems such as high blood pressure. But stress will affect your performance at work, leading to other work-related disciplinary issues or even firing. With so much stress, it’s always hard to focus on finding solutions to your financial woes; instead, most people would seek comfort from substance abuse.

Mental Health

The reality of colossal debt is that you never seem to catch up if you allow it to grow exponentially. Debt with high interest rates can grow so fast that you never get your foothold no matter what you do. The constant worries and stress can quickly amount to psychological problems, depression, and anxiety. It’s always important to keep the debt you already have under control and pay it off as soon as possible. Living without debt will leave more money in your pocket, and you can afford to treat yourself.

Damaged Credit

The fact is that failing to meet your debt obligations is a nightmare for your credit and credit score. When you have late or missed payments, your credit is damaged and will need to be repaired, which is a lengthy process. It takes seven years for negative information to stay on your credit. As a result, lenders will not allow you to borrow money cheaply to purchase a home, car, or loan to start a business. Therefore, your credit is your powerful asset, and you must protect it, especially for people living in the western world.

Affect Relationships

Living in a debt-ridden environment with constant stress and anxiety causes a deep strain on relationships, resulting in conflict, arguments, and fights. Debt can also hurt communication because most people don’t like to talk about money creating a frustrating environment. In some cultures, having too much debt can prevent people from getting married or planning to have children. Therefore, you should always strive to live debt-free to improve your quality of life.

In conclusion, now that you know that unnecessary debt is the leading cause of stress and health issues, it is always good to limit your debt burden. The less debt you have, the better your financial health. And as a result, you will have more money in your pocket to build your financial future.