Your Credit Utilization: How to Manage It

Utilizing your credit correctly is critical to managing your credit. You can keep a good credit score and enhance your financial security by managing and optimizing your credit usage. The article will examine the idea of credit utilization, and how it affects your credit score, and offer helpful management advice.

Understanding of Credit Utilization

Credit Utilization: What Is It?

The percentage of your available credit that you are now using is referred to as credit usage. It is determined by dividing all your credit cards’ balances by the total credit limit. Your credit utilization ratio would be 20%, for instance, if your credit card has a $5,000 limit and you have a $1,000 balance.

Use of Credit: How Important Is It?

Your creditworthiness is largely influenced by your credit consumption. Lenders take it into account when determining your credit risk. A low credit usage ratio shows that you are managing your credit responsibly and that you are not unduly dependent on credit.

How to Determine Credit Utilization

Add up the balances on all of your credit cards, then divide that total by the combined credit limit on all of your cards to determine your credit utilization ratio. To calculate the percentage, multiply the outcome by 100.

Your credit card balances to credit limits are compared to determine your credit utilization. It calculates the percentage of your available credit that is currently being used.

You can use the following methods to determine your credit utilization rate:

- Compile the outstanding balances on all of your credit cards to determine your total credit card balances.

- Add together all of your credit cards’ credit limits to find your overall credit limit.

- Subtract the entire balance on all of your credit cards from the total credit limit.

- To obtain a percentage, multiply the value by 100.

Here is a calculation example to help you understand it:

If you have three credit cards with the following balances and credit limits, for example:

Card 1: $1,000 in available credit; $5,000 credit limit

Card 2: Has a $500 balance and a $2,000 credit limit.

Card 3: $2,500 in available credit; $10,000 credit limit

In order to determine your credit utilization:

The sum of credit card balances: $4,000 = ($1,000 + $500 + $2,500).

Credit limit total = $5,000 plus $2,000 plus $10,000, which equals $17,000.

Credit utilization equals $4,000 divided by $17,000, which equals 0.2353

0.2353 times 100, and 23.53%, is the credit utilization rate.

Your credit utilization in this case is 23.53%. It shows that you are utilizing roughly 23.53% of your credit limit. In general, a lower credit utilization ratio is preferable because it shows careful credit management.

The Effect of Credit Utilization on Your Credit Score

Credit Scores Fundamentals

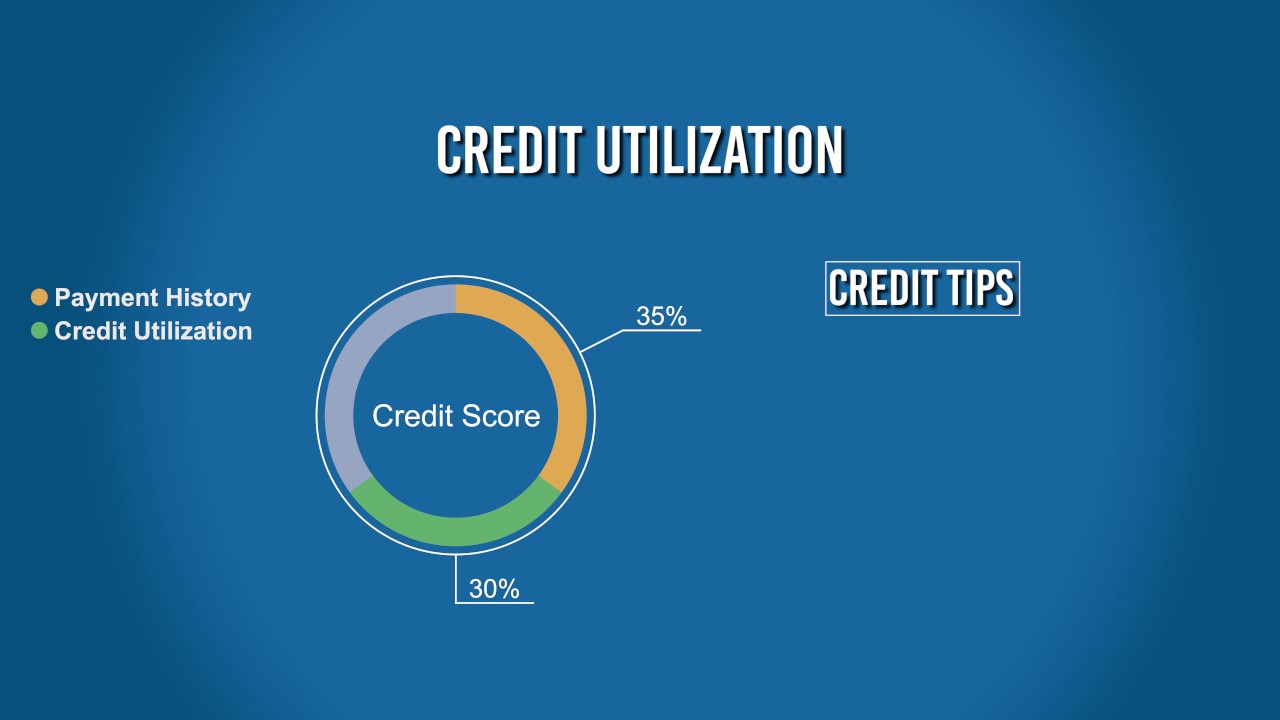

A three-digit figure that measures your creditworthiness is your credit score. Your payment history, credit utilization, length of credit history, forms of credit, and recent credit inquiries are just a few of the variables that go into calculating it.

The Connection Between Credit Scores and Credit Utilization

Your credit score is significantly impacted by your credit utilization. Maintaining a credit usage percentage under 30% is advised. Higher credit utilization ratios can lower your credit score as they may indicate financial hardship or an inability to responsibly manage credit.

Most Effective Credit Utilization Ratio

Although it’s typically a good idea to keep your credit usage ratio below 30%, the lower the ratio, the better. For the best benefits, aim for a credit usage ratio of 10%.

Guidelines for Managing Credit Usage

Planning strategically and maintaining a strict financial discipline are necessary for managing your credit utilization. You may control your credit utilization successfully by following these vital tips:

Regularly check your credit usage: Pay close attention to your credit utilization ratio to make sure it stays within safe ranges. Regular monitoring enables you to spot possible problems early and implement fixes.

Maintain Low Credit Card Balances: Don’t overload your credit cards with debt. Keep your balances as low as possible, or try to pay them off each month. As a result, the credit usage ratio is kept low.

Paying bills promptly and on time: Your credit score and credit utilization can suffer as a result of late payments. Paying your bills on time indicates prudent credit management, so make it a priority.

Think about raising credit limits: To request a credit limit increase, get in touch with your credit card company. Lowering your credit use ratio can be accomplished by increasing your credit limit while keeping modest balances.

Refrain from opening several new accounts: Lenders may become concerned if you open a lot of new credit accounts quickly. Your credit score could be harmed and your credit utilization ratio could increase as a result.

Strategic Debt Reduction: If you have a number of credit card balances, you might want to start by paying off the ones with the highest interest rates. This strategy can lower your overall debt while saving you money on interest payments.

Balance Transfer Options to be Used: If you have credit card debt with a high-interest rate, you could choose to transfer the balances to a card with a reduced interest rate. You can control your credit use more skillfully and combine your debt with the aid of this method.

If necessary, seek professional advice: Consider speaking with a credit counselor or financial advisor if you are having trouble managing your credit or if you have a lot of debt. They can offer you individualized advice and assist you in creating a strategy to increase your credit use.

Principles to Follow to Maintain a Healthy Credit Utilization

Here are some effective methods to keep a healthy credit utilization in addition to the aforementioned advice:

Create a Budget: To keep track of your spending and ensure you can comfortably manage your credit commitments without exceeding your means, create a monthly budget.

Pay Your Bills Frequently: Consider making several payments throughout the month as an alternative to waiting until the due date. This can assist in lowering your credit utilization ratio and keeping your debt low.

Expand Your Credit: A variety of credit products, including credit cards, loans, and mortgages, can help your credit score. Nevertheless, ensure that you only accept credit that you can handle responsibly.

Maintain Old Accounts Active: Your credit score is heavily influenced by the length of your credit history. Keep previous credit card accounts open because they build your credit history and can lower your credit utilization percentage.

Before closing accounts, think twice: Even though it could be tempting, think about how closing unused credit card accounts might affect your credit utilization percentage. Your credit availability is decreased by closing accounts, which could result in a higher credit use rate.

Lastly, to keep your credit score strong and your finances stable, you must control your credit utilization. You can increase your creditworthiness and gain access to greater financial prospects by comprehending the notion of credit utilization, consistently monitoring it, and putting successful techniques into practice. Keep in mind to pay your payments promptly, maintain a low credit utilization ratio, and seek professional advice if necessary.

FAQs

A healthy credit usage ratio is what?

Generally speaking, a desirable credit utilization ratio is under 30%. For best credit health, it is advised to keep the percentage around 10%.

Can my credit score be negatively impacted by a low credit use ratio?

No, having a low credit use ratio usually boosts your credit score. It exhibits stable financial management and responsible credit use.

How often should I check the utilization of my credit?

It’s a good idea to check your credit utilization if you plan to apply for new credit or at least once every few months. Regular monitoring enables you to keep informed and, if necessary, take the proper action.

Will paying down the entire sum on my credit card increase my credit utilization?

Yes, reducing your credit usage ratio dramatically by paying off your credit card bill in full. It decreases the amount of debt that is displayed in your ratio and demonstrates that you are not highly reliant on credit.

Should I close accounts on my unused credit cards?

Account closures for idle credit cards might not always be advantageous. Your available credit may be reduced, which could result in a rise in your credit utilization percentage. Before making a choice, consider the effect on your total credit profile.